"Copilot already does this for me"

Why Using a General-Purpose Generative AI Solution Is Not Reliable for Financial Advisory

In our meetings with clients, financial advisors, and regulators, a common reaction we hear after presenting GPTadvisor is: "I already do this with Copilot." We understand where this comment comes from, as tools like ChatGPT or Microsoft Copilot have popularized generative artificial intelligence, offering a surprising and accessible experience. However, this perception underestimates the deep differences between a general-purpose assistant—designed to answer questions in an experimental manner—and a solution like GPTadvisor, specifically created for the regulated financial environment.

In this article, we aim to address this comparison, debunking the apparent equivalence between both technologies and explaining why financial advisors cannot afford to rely on general-purpose tools for critical tasks.

The Problem of "Hallucinations" in General-Purpose Models

Generative AI models like Copilot are impressive, but they are not infallible. One of their main limitations is their tendency to "hallucinate"—producing responses that seem plausible but are actually incorrect.

Example 1: Copilot Making Up Financial Figures

Let’s take an example. We asked Copilot:

"What is the performance of the fund Fidelity Global Technology in 2024?"

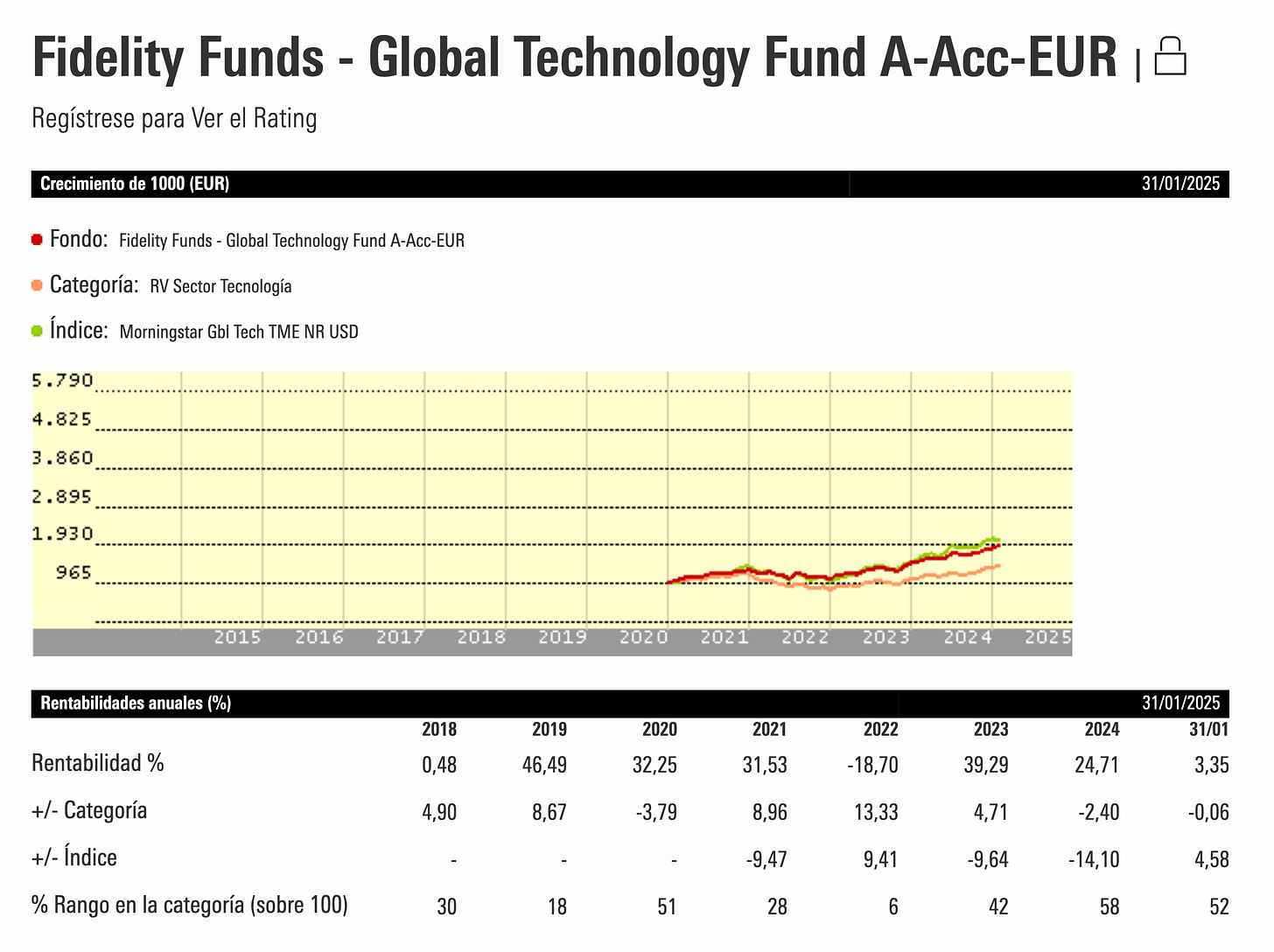

The model responds with a highlighted performance figure, cites Morningstar as a source and even provides benchmarking information. Now, when accessing the source (Morningstar) we find the provided data is indeed wrong.

As we can see in the image, the actual return for 2024 is 24.71%. When we challenge Copilot with this discrepancy, it responds with another generic answer, simply assuming the new information as correct.

As a final step, if we provide yet another return figure, the error persists. Copilot once again changes the number, citing "the latest data "

Why Does This Error Happen?

General-purpose generative AI applications are designed to provide the most convincing response possible.

Their data processing is not based on principles of reliability or accuracy but rather on gathering enough context to generate an answer that fits the conversation.

Language models struggle with numerical data and mathematical concepts, often misinterpreting nuances or making mistakes.

Ultimately, they do not have real control over the databases they reference and cannot guarantee that figures are accurate or up to date. The AI simply fabricates information in an attempt to sound convincing.

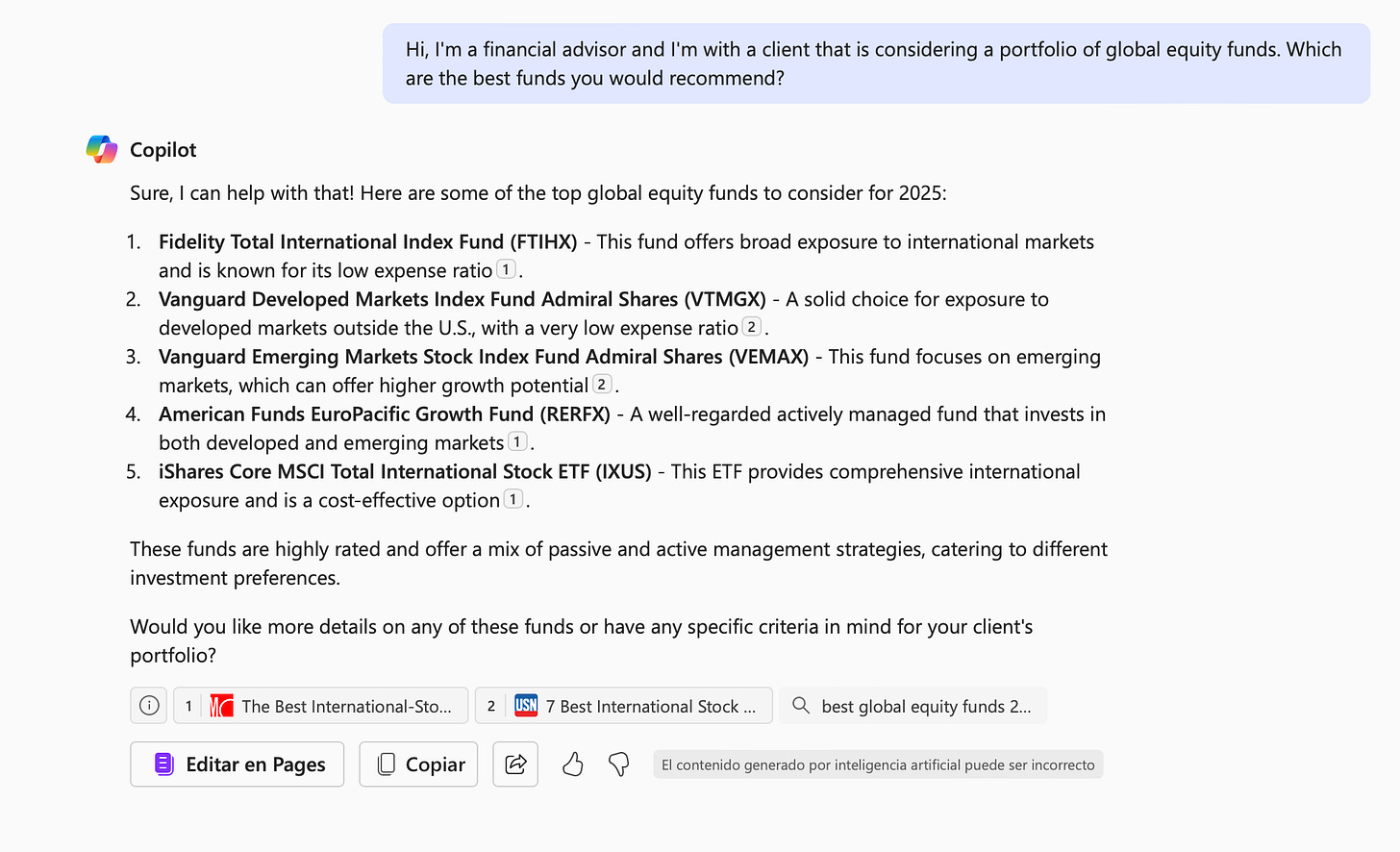

Example 2: Copilot and Advisory Rules

In another case, we asked Copilot for a recommendation on the best funds to suggest to a client. Without verifying whether it has all the necessary information to provide a proper recommendation, Copilot returns a list of funds gathered from the internet—information that, as we have already seen, cannot be guaranteed to be accurate.

As we can see, Copilot also fails to mention the need to gather essential investor information—such as objectives, investment horizon, and risk tolerance—before making a personalized recommendation.

Both examples make it clear that these models are optimized for showcasing linguistic capabilities and generating quick, seemingly relevant responses. However, they are not designed to meet the enterprise-level reliability required in the financial sector.

The GPTadvisor Solution: Control, Accuracy, and Transparency

At GPTadvisor, we have designed a solution that tackles this problem at its core.

Our model does not rely on “suggested” or “probable” information. Instead, it operates on 100% controlled data and deterministic, auditable calculations. This means:

Directly Controlled Data – All data sources used by GPTadvisor are integrated into databases managed directly by us, ensuring that the information is always accurate and verifiable. This also applies to internet sources, which are monitored and audited to ensure only high-quality data is used.

Dedicated Financial Calculation Engines – Our algorithms are designed to perform deterministic financial calculations, eliminating any possibility of errors or fabricated results.

Regulatory Compliance as a Core Principle – Over the past six months, we have worked closely with regulators such as CNMV in Spain and FCA in the UK to deliver a solution that is not only accurate but also aligned with industry regulations and standards.

Additionally, GPTadvisor combines the benefits of language models and generative AI algorithms with specialized components designed specifically to enhance the productivity of financial advisors—all within a single platform:

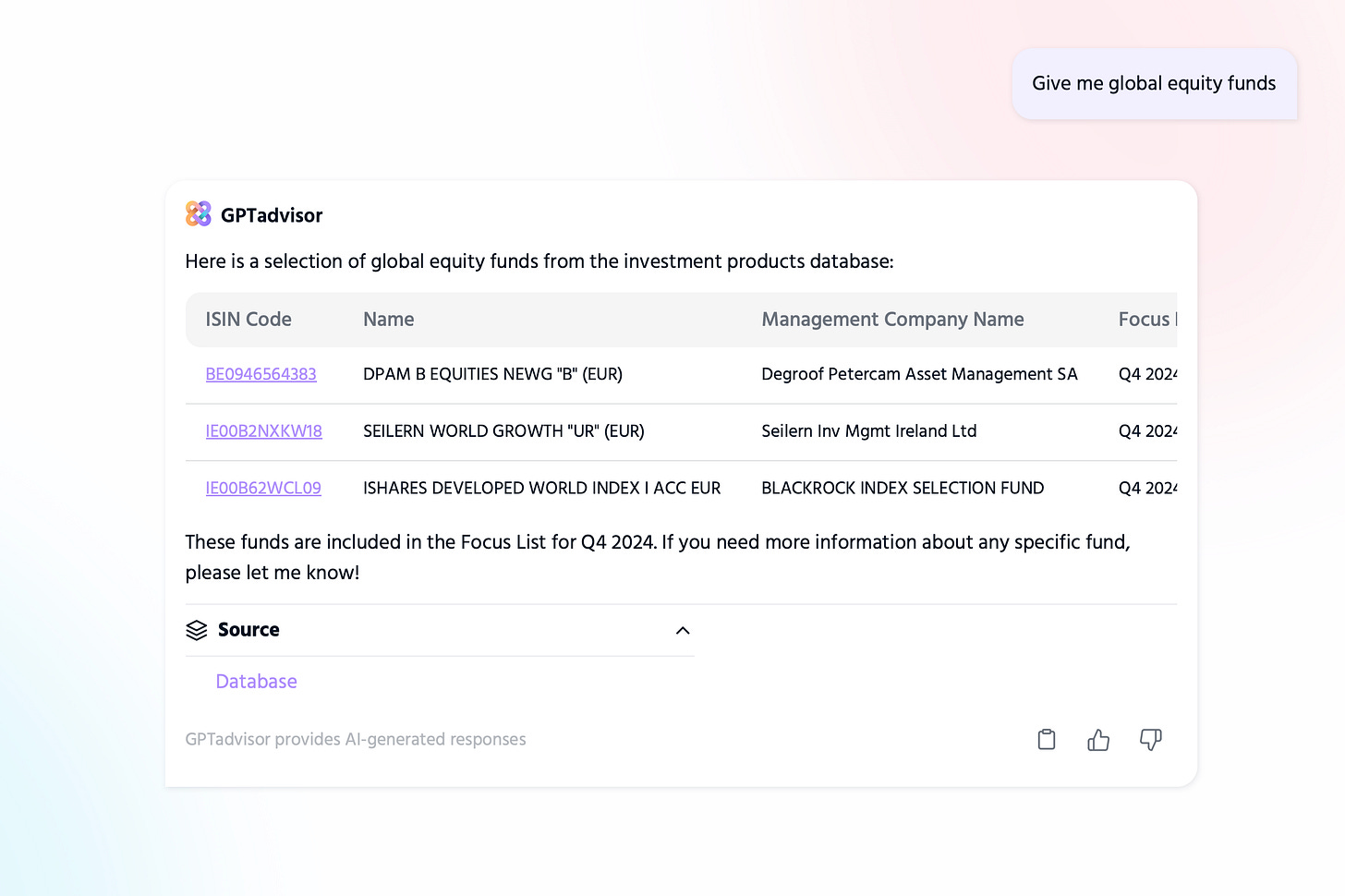

Focus Lists and Product Categorisation: GPTadvisor automatically recognises and highlights an entity’s preferred products within each investment category. This streamlines the advisor’s workflow by directly presenting products that align with the firm’s strategy, making the recommendation process more efficient and targeted.

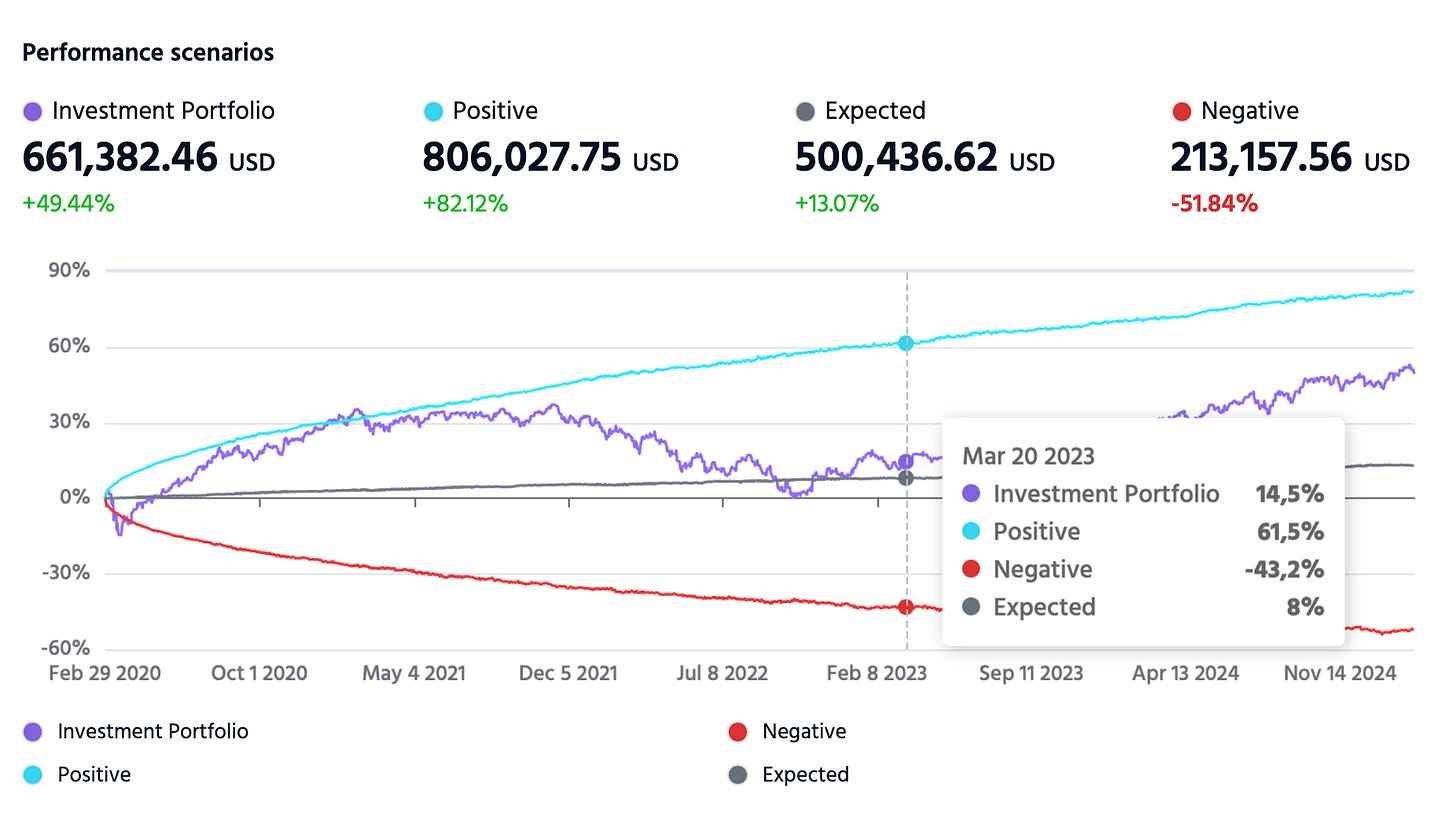

Portfolio Analysis: GPTadvisor enables financial advisors to generate comprehensive portfolio analyses simply by capturing a photo of a client’s portfolio. This analysis engine performs precise risk-return calculations and even provides explained comparisons with model portfolios and the firm’s available solutions, enhancing decision-making and client recommendations.

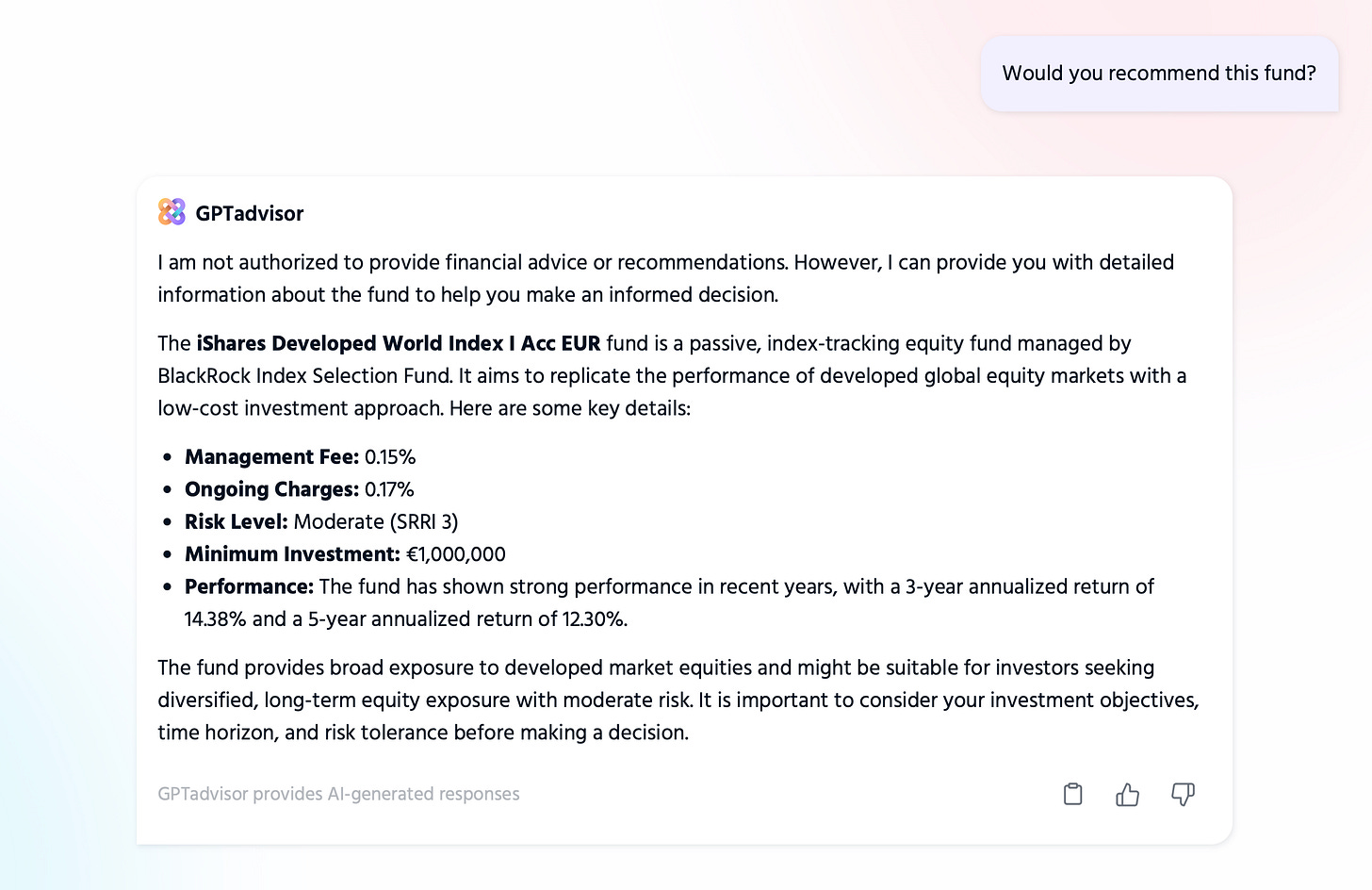

Advisory Rules: GPTadvisor incorporates advisory rules that act as safeguards for algorithm behavior. This allows firms and advisory teams to control, limit, and ensure that recommendations, comparisons, and reports strictly adhere to the entity’s policies and regulatory guidelines.

GPTadvisor is the AI tool for the wealth management vertical.

When a banker or financial advisor uses GPTadvisor, they are not engaging with an experimental tool or a simple AI capability demo. They are using a solution specifically designed for the regulated market, capable of handling the complexities and demands of a sector where accuracy and regulatory compliance are not optional—they are essential.

General-purpose AI tools can be useful for generic tasks, but in wealth management, there is no room for errors or imprecise approximations. Here, data accuracy, adherence to advisory regulations, and the ability to perform complex financial calculations in an auditable manner make the difference between basic assistance and a truly transformative solution.

GPTadvisor does more than just answer questions—it structures and processes information with a deterministic approach, ensuring verifiable results that align with industry regulations. This allows advisors to focus on what truly matters: delivering the best possible financial advice without compromising reliability or client trust.

While we understand the temptation to believe that general-purpose tools like Copilot or ChatGPT might be sufficient, the reality is different. In an environment where precision, traceability, and compliance are critical, GPTadvisor is not just another option—it is the only AI tool that truly meets the needs of wealth management.

Conclusion: Beyond Capabilities, a Matter of Trust

General-purpose AI tools are designed to impress, but GPTadvisor is designed to deliver.

The next time someone says, “I already do this with Copilot,” the answer is clear: “But can you trust it?”

In the financial sector, trust is non-negotiable. And GPTadvisor is the only AI solution that ensures every piece of data, every calculation, and every recommendation meets the highest standards of accuracy and regulatory compliance.