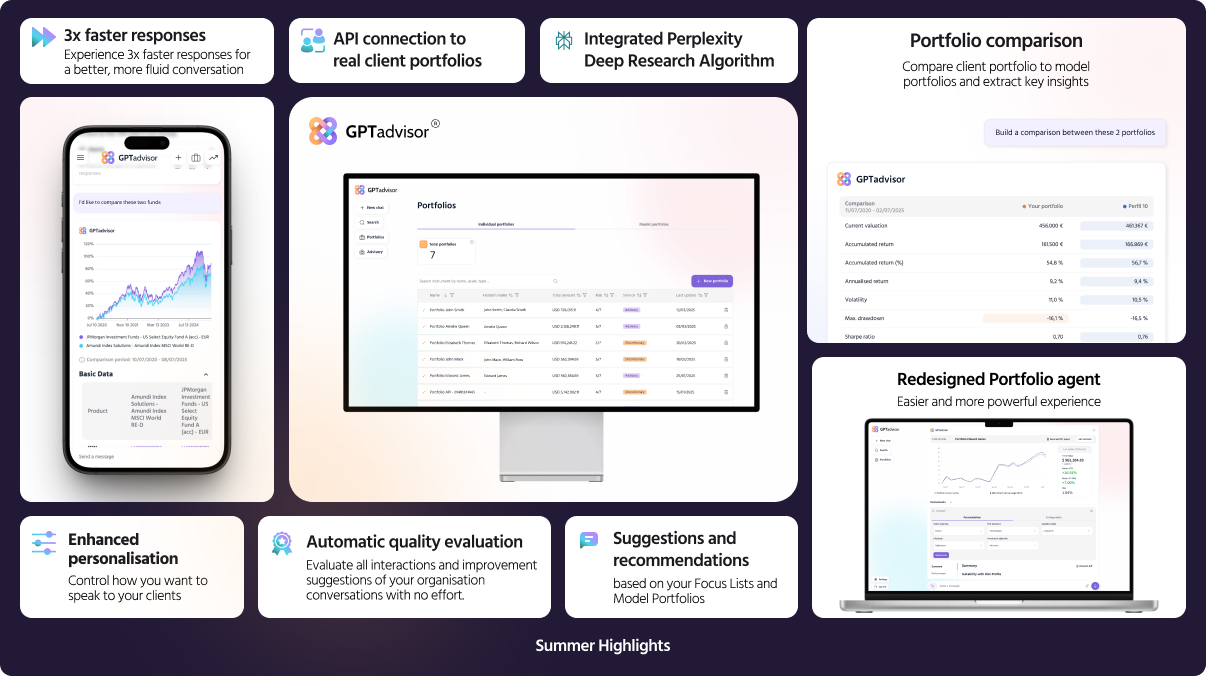

GPTadvisor Summer 2025 release: Big improvements to boost adviser productivity

Lightning fast response speed and a fully redesigned portfolio agent to boost your day as an adviser.

At GPTadvisor, we’re committed to continuously evolving your experience. This summer, we’re rolling out powerful updates designed to enhance the intelligence of your portfolio AI agent and to make the platform more intuitive and seamless. These improvements will help you serve your clients with greater speed, confidence, and precision.

Check out the latest highlights

Up to 3x faster response times

We’ve reengineered our conversation engine to deliver dramatically improved performance:

Lightning fast response time

We’ve reengineered our conversation engine using advanced prompt optimization and parallel processing techniques, resulting in up to 3x faster response times. This means more fluid, dynamic interactions that keep pace with your thinking. Whether you’re exploring complex portfolios or refining investment strategies, the AI now responds with greater speed and continuity, enhancing both usability and decision-making flow.

Watch a side-by-side comparison in action to see the difference.

Fully transparent interactions

Our AI now provides real-time visibility into its reasoning process, so you’re never left guessing how an answer is being formed. As the AI works, you receive live feedback on its internal steps: from content retrieval from documents, database queries, calculations, evaluation, and response generation. This added transparency builds trust, enhances explainability, and gives wealth managers greater confidence in every interaction.

Watch a live example below:

Redesigned Portfolio AI Agent

After several months of our initial portfolio agent already in production to hundreds of advisors, we have developed a completely redesigned version of the agent with enhanced features and a much more intuitive user interface:

New intuitive interface

We’ve introduced a new interface that makes it easier than ever to navigate directly to specific features within each analysis. You can now go straight to the insights that matter most, without unnecessary clicks or complexity.

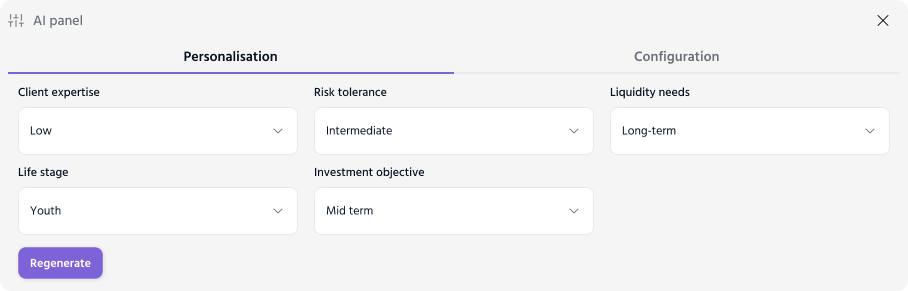

Personalisation Panel

Enhanced personalisation panel to control how you want to speak to your clients. Advisers now use MiFID parameters to control how the AI is explaining, reasoning and utilising all available data to provide the best insights and resources.

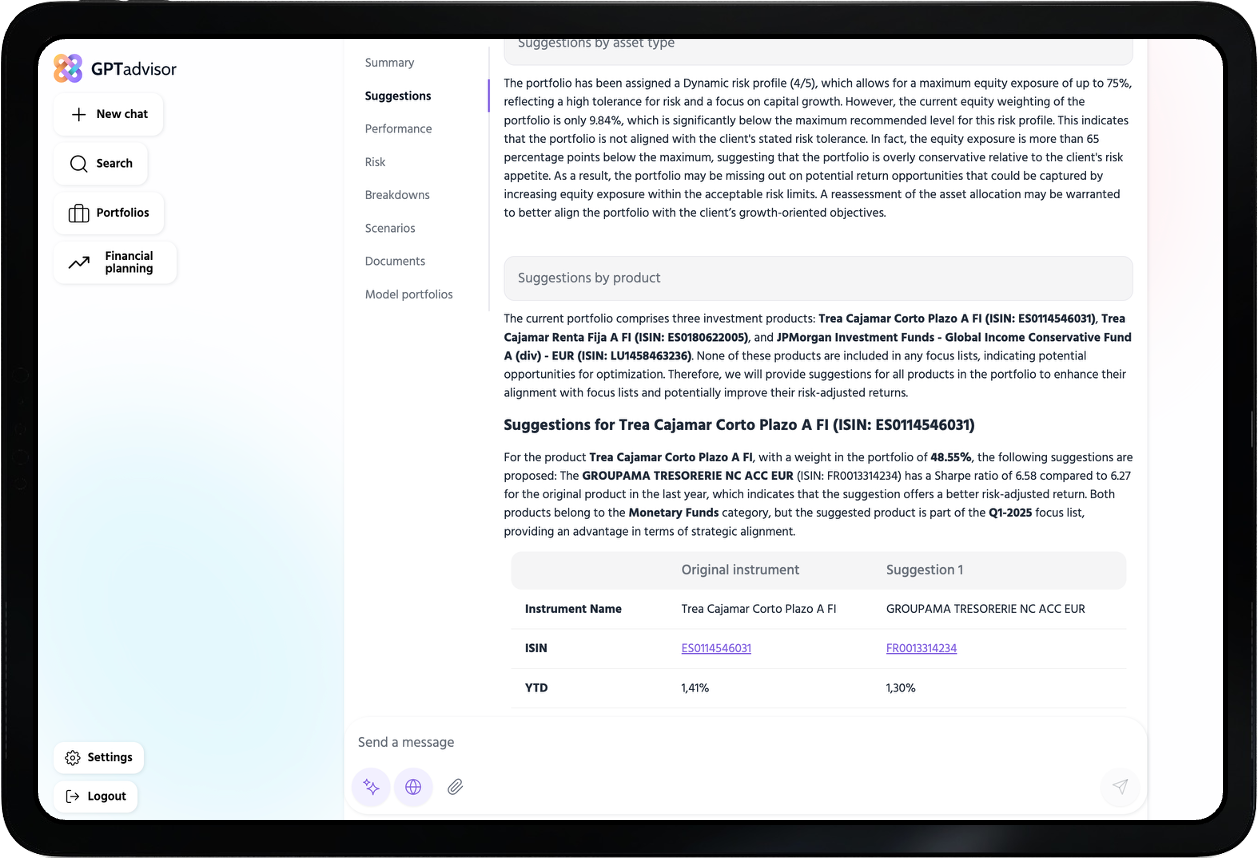

Included suggestions and recommendations

Receive intelligent, automatic recommendations aligned with your institution’s strategic risk profiles and preferred product lists. Suggestions are organised by asset type, making it easy to identify gaps, reinforce allocations, or improve existing holdings with similar alternatives that better match your firm's strategy. The result: portfolios that stay aligned with your internal strategy while remaining adapted to each client.

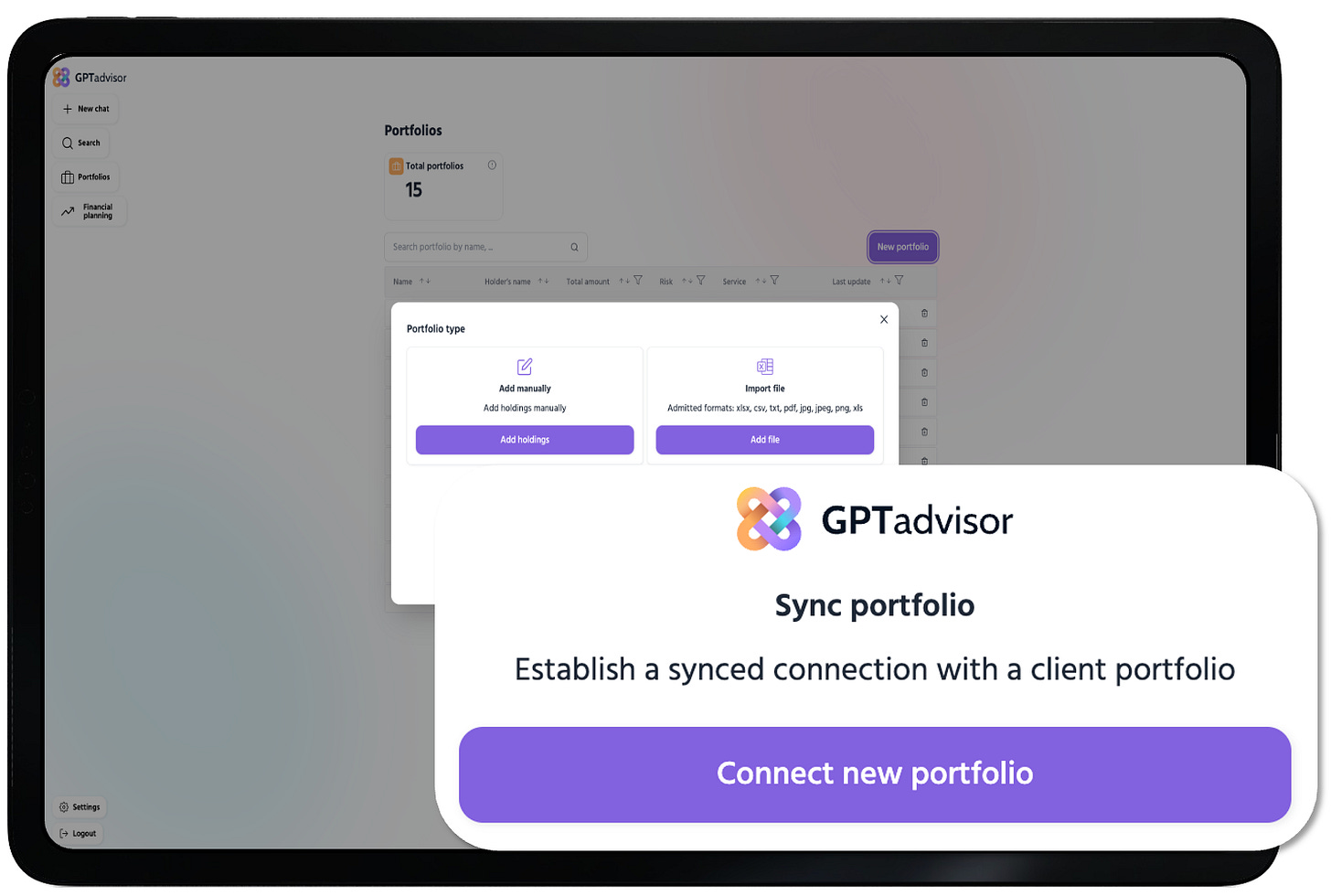

Sync your clients’ portfolio automatically

Save time and reduce manual work with our new API integration: advisors can now connect a real client portfolio simply by entering the client’s account number. The system securely retrieves the full portfolio data directly from the entity’s internal systems, preserving privacy on personal information. Enable instant analysis without the hassle of introducing client information..

Integrated Perplexity Deep Research Algorithm

Our platform now includes a more powerful Perplexity Deep Research algorithm, giving you the power to explore the macroeconomic landscape with unmatched depth. This integration delivers comprehensive answers to complex questions, covering trends, risks, and economic outlooks. The responses go beyond quick summaries, offering detailed narratives that combine clarity, breadth, and relevance. This is ideal for supporting investment decisions or enriching client conversations.

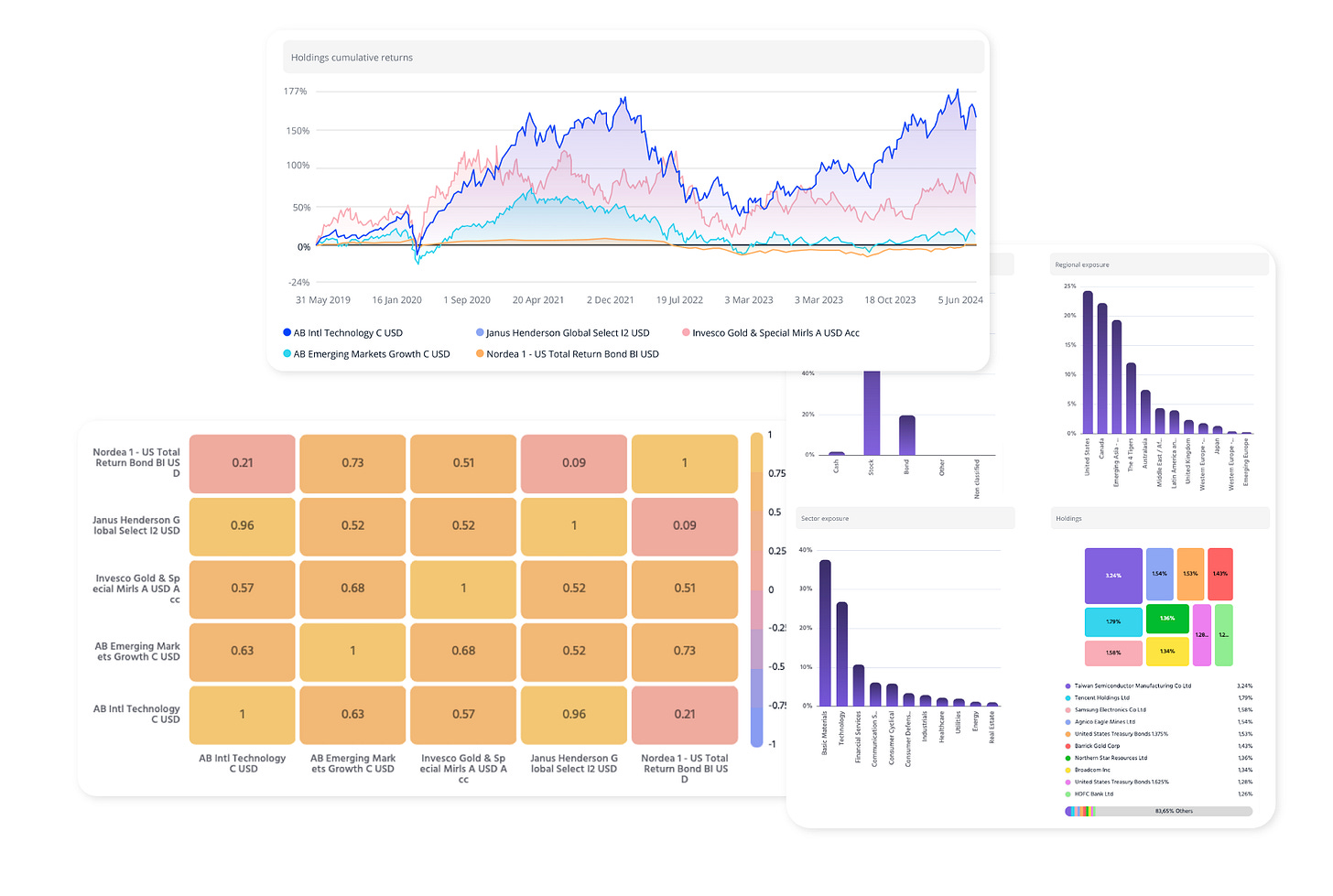

Deeper Market Data & Strategy Look-Through

Gain a clearer view into investment strategies with enhanced market data and look-through capabilities. Our platform now offers expanded visibility into underlying exposures, enabling you to understand exactly how each portfolio is positioned. A wide range of performance and risk metrics, combined with interactive visuals and breakdowns by asset class, sector, geography, and more. This makes it easy to analyse strategies in context and communicate insights effectively.

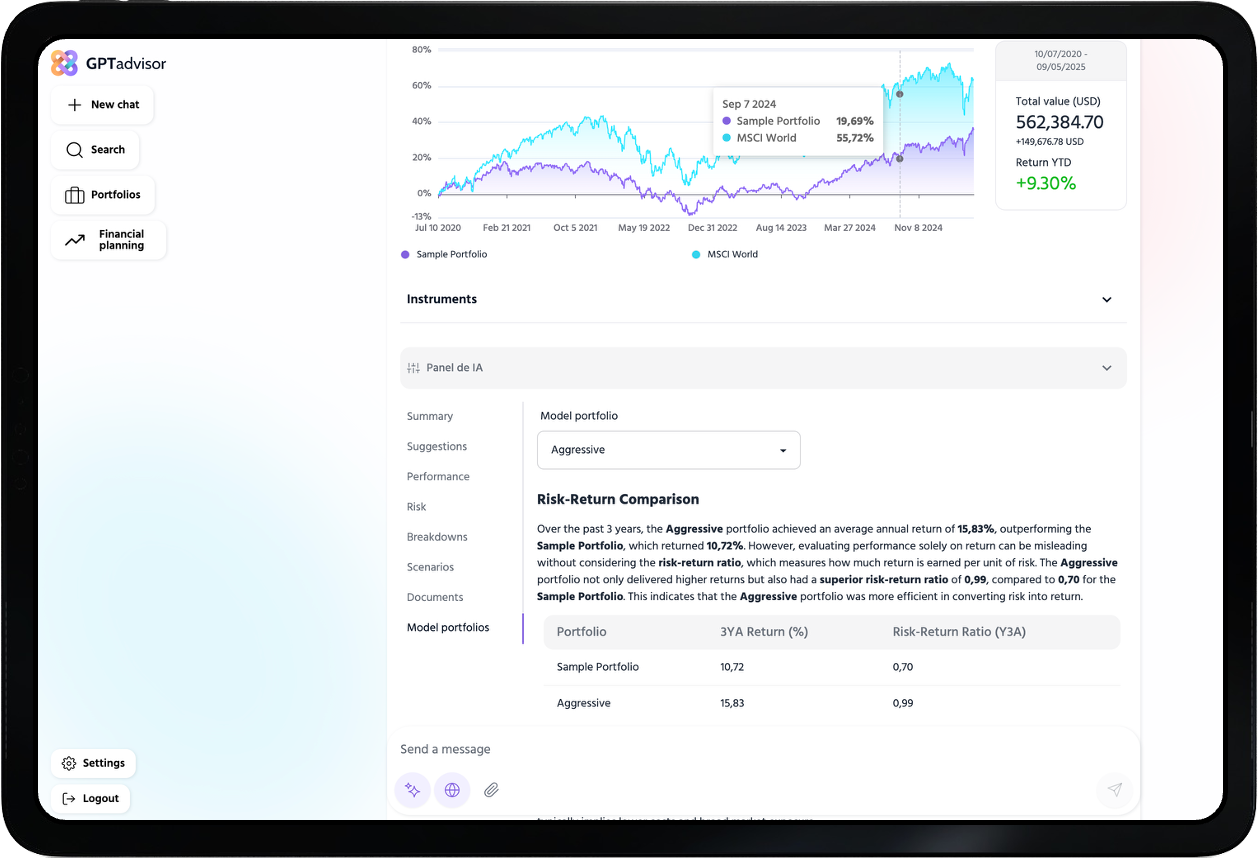

Portfolio comparison including explained argumentation

We deliver high-quality portfolio comparisons by allowing users to benchmark any portfolio against a range of model portfolios. Each comparison includes a clear, comprehensive explanation, highlighting alignment with the client’s risk profile, asset allocation, product types, and more.

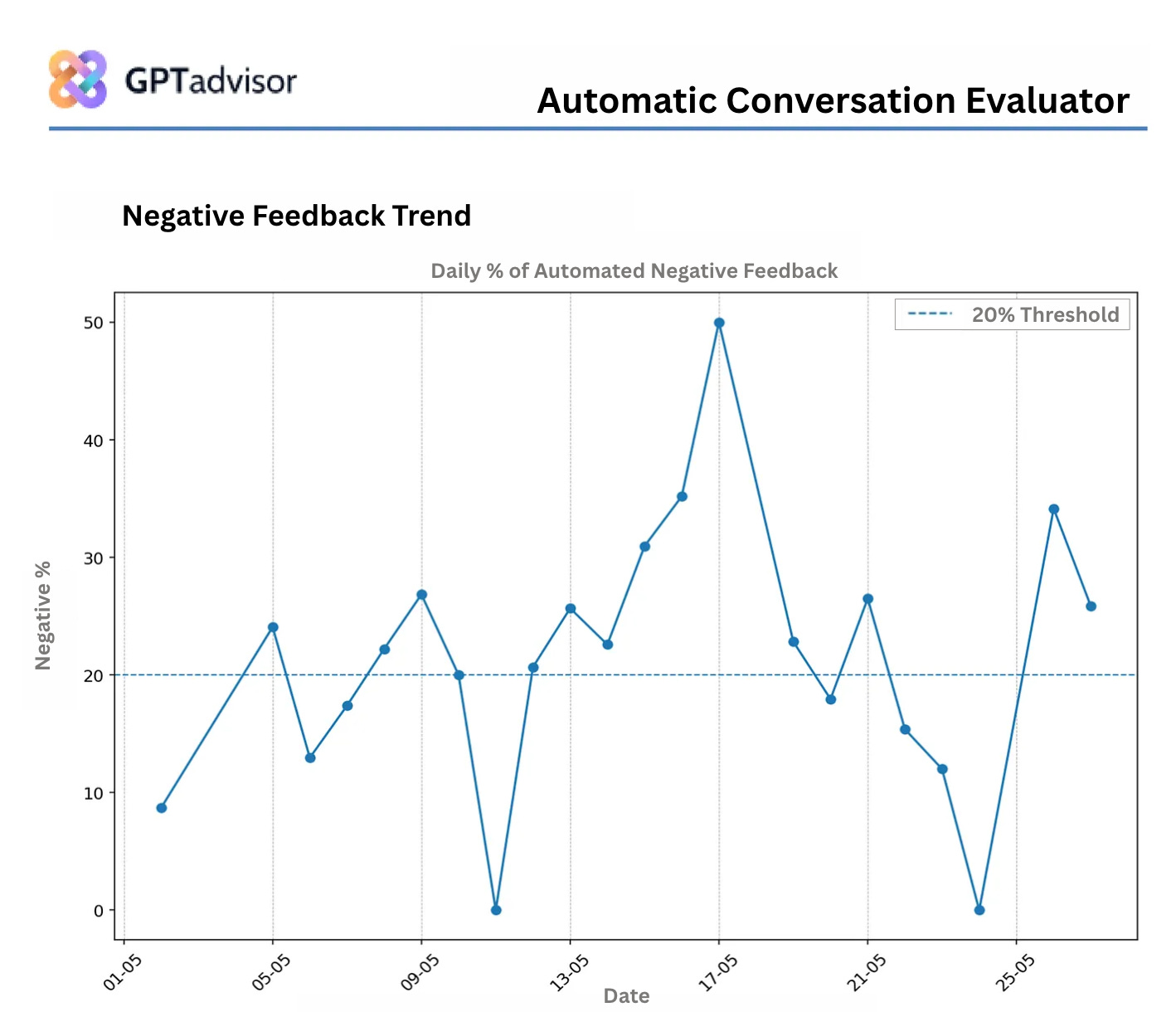

One more thing… we now have an AI evaluator

What is an AI evaluator?

Evaluator is our new fully autonomous, AI-powered review tool. It lets you assess all your organization’s conversations effortlessly, delivering quality feedback and actionable suggestions for improvement. You can run evaluations on-demand or schedule them regularly, and receive a branded PDF report tailored to your firm. We’ll be publishing a detailed article soon on how to make the most of it. In the meantime, here’s a preview: